For registered investment advisers (RIAs), navigating today’s regulatory landscape requires more than just good intentions. It demands structured, strategic action. With increasing scrutiny from the Securities and Exchange Commission (SEC), evolving regulatory obligations, and rising client expectations, firms must adopt robust RIA compliance strategies to remain competitive, compliant, and client centric.

Whether you’re launching a new RIA firm or scaling an established practice, the ability to implement and maintain an effective compliance program can make or break your long-term success.

Why RIA Compliance Is More Than a Checkbox

RIA compliance isn’t just about satisfying the Investment Advisers Act of 1940 or checking off a RIA compliance checklist. It’s about building a culture that aligns your investment strategies, client service, and trading practices with applicable regulatory requirements, ethical standards, and industry best practices.

Failure to do so can result in serious consequences, including enforcement actions, loss of registration, or reputational damage.

1. Establish a Robust RIA Compliance Program

At the heart of any strong RIA is a compliance program tailored to the firm’s size, structure, and business operations. A successful RIA compliance program includes:

- Written policies and procedures that reflect the firm’s actual practices

- A code of ethics governing personal trading and conflicts of interest

- A clearly defined procedures manual accessible to all supervised persons

- A process for maintaining accurate records of compliance activities, client agreements, and disclosure practices

- Regular annual reviews and regulatory rule updates to adapt to regulatory changes

These elements must be documented and executed consistently to meet regulatory standards and ensure the protection of client assets and information.

2. Appoint a Capable Chief Compliance Officer

Your Chief Compliance Officer should have both compliance expertise and sufficient authority to implement changes across departments. A CCO’s core compliance responsibilities include:

- Leading regular compliance reviews

- Reviewing marketing materials for adherence to disclosure requirements

- Overseeing client communications

- Managing recordkeeping requirements for client accounts and portfolio management

- Coordinating with any compliance consultants or third-party vendors supporting the firm

Your CCO should not only enforce existing policies but also anticipate regulatory changes and develop procedures designed to adapt accordingly.

3. Create and Maintain Written Policies and Procedures

The Advisers Act requires RIAs to adopt written policies and procedures that are designed to prevent violations of the Investment Advisers Act and regulatory rules.

These policies should be:

- Specific to your firm’s operations

- Focused on providing financial advice, managing client information, and handling client accounts

- Designed to ensure transparency and protect investors

- Aligned with compliance software or documentation systems used for reporting

Firms should perform periodic audits and keep their procedures manual updated as both their services and the regulatory landscape evolve.

4. Focus on Continuous Education and Compliance Awareness

Ongoing education for supervised persons is essential. This includes:

- Training on RIA compliance requirements, fiduciary duty, and changes to regulatory guidelines

- Reviewing case studies and industry news that highlight enforcement actions

- Encouraging discussions on compliance scenarios, such as improper disclosure practices or insufficient recordkeeping

Investing in continuous education not only supports a strong compliance culture but also reduces risk by enabling early detection of red flags.

5. Conduct Annual Reviews and Internal Testing

SEC-registered firms are required to conduct annual reviews of their compliance policies and procedures. These reviews should analyze:

- Client agreements and prospective clients acquisition practices

- Communication records, advertisements, and marketing materials

- Compliance with disclosure and fiduciary requirements

- Effectiveness of internal processes and compliance activities

Annual reviews are a vital opportunity to catch issues early, adapt to changes in firm size or scope, and prepare for regulatory examinations.

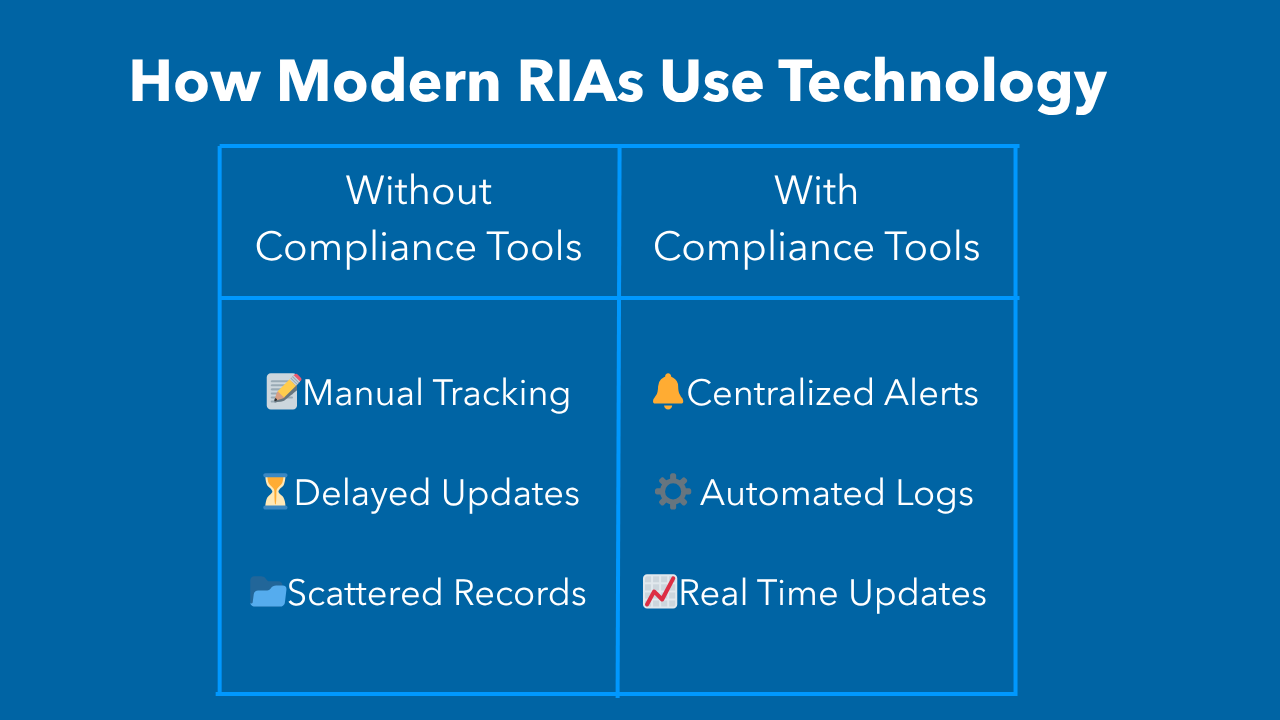

6. Leverage Compliance Tools and Third-Party Support

Modern RIAs increasingly rely on compliance software to streamline policy enforcement, record keeping, and workflow management. This includes tools for:

- Monitoring personal securities transactions

- Logging and reviewing client communications

- Centralizing updates to written code or internal policies

- Alerting teams to potential breaches of regulatory compliance

When internal resources are limited, working with a compliance consultant can provide outside compliance expertise and help assess whether your firm meets its RIA compliance requirements.

Strategy Is the New Standard

In an environment shaped by constant regulatory changes, investor expectations, and digital transformation, compliance is no longer reactive, it’s strategic.

By building and maintaining a robust compliance program, empowering your Chief Compliance Officer, aligning with regulatory obligations, and embedding compliance into every layer of your business, your RIA firm will be positioned to serve clients with confidence and grow with integrity.

Looking to optimize your RIA compliance strategy?

Our team helps registered investment advisors strengthen their compliance posture with customized support, regulatory updates, and practical insights that go beyond the basics.

Want to take the stress out of RIA compliance? Skematic can help.Request a Demo