In today’s highly regulated environment, RIA compliance is more than a legal requirement. It’s a business necessity. For investment advisers and registered investment advisers (RIAs), staying compliant with evolving SEC regulations and state regulatory requirements can be overwhelming without the right tools. That’s where RIA compliance software comes in.

Behind the scenes, these platforms do more than just check boxes, they streamline your compliance process, reduce risk, and help your firm scale with confidence.

What Is RIA Compliance Software?

RIA compliance software is an online platform that helps advisory firms automate, track, and manage their obligations under federal and state regulators. These systems centralize your compliance program, making it easier to manage everything from Form ADV filings to risk assessments, marketing reviews, and personal trading policies.

Whether you’re a large investment management firm or a state-registered advisory business, the right platform acts as a one-stop shop for meeting your regulatory compliance responsibilities.

How RIA Compliance Software Works Behind the Scenes

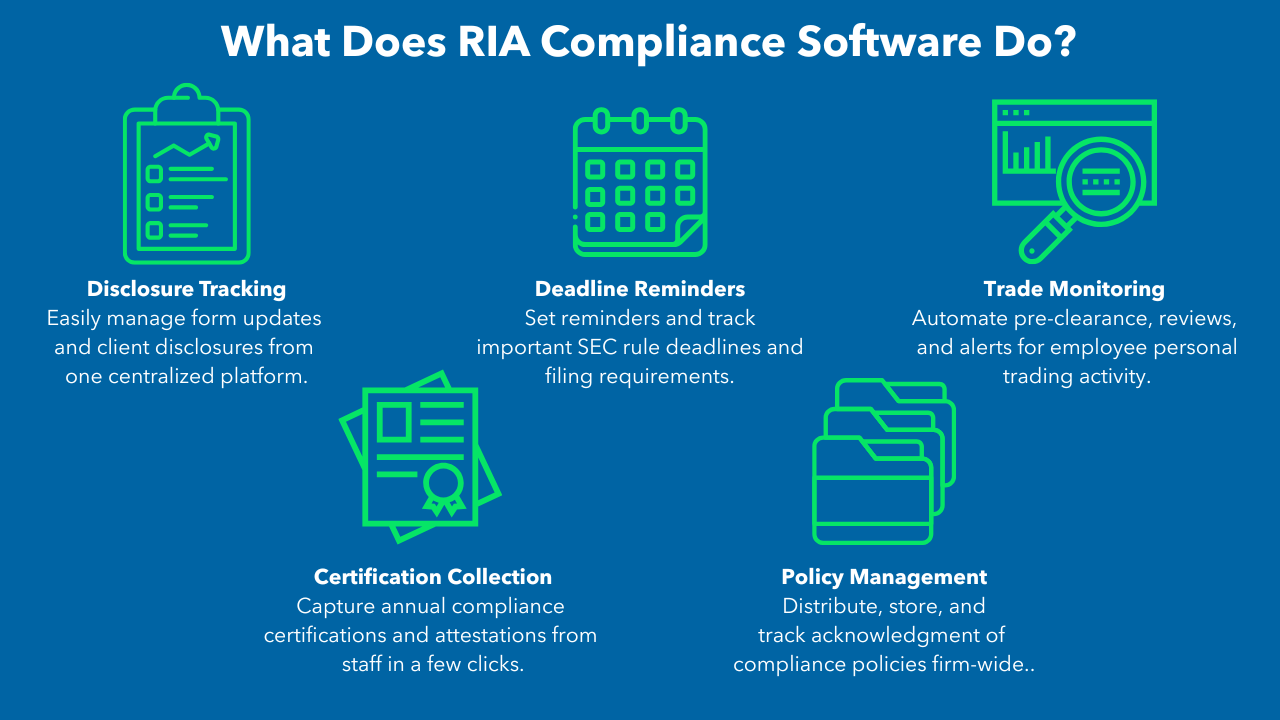

Here’s a look at what’s actually happening under the hood of top RIA compliance technology:

1. Centralized Compliance Management

Compliance software serves as a command center, enabling firms to manage:

- Disclosure documents

- SEC rule deadlines

- Personal trade monitoring

- Annual compliance reviews

- Staff certifications and attestations

The platform gives compliance experts, compliance consultants, and internal staff a clear, structured view of what’s happening in real time.

2. Automation of Manual Processes

Manual reviews, spreadsheets, and emails are risky and inefficient. Compliance solutions now automate:

- Employee trade pre-clearance

- Email archiving

- Marketing material reviews

- Policy delivery and acknowledgment

This reduces the chance of missing key deadlines and allows advisers to focus more on serving clients and less on paperwork.

Why Investment Advisers Need Modern Compliance Tools

RIAs face an increasingly complex mix of SEC regulations, regulatory requirements, and due diligence expectations from both clients and regulators. RIA compliance software is essential for:

- Ensuring firms comply with every applicable rule

- Reducing regulatory risk

- Creating a defensible audit trail

- Lowering the overall costs of compliance

- Supporting transparency and trust

The best compliance tools are built by former regulators and extremely knowledgeable industry professionals who understand what’s required for real-world regulatory compliance.

The Value of Working with Third-Party Vendors

While some firms try to manage everything in-house, others partner with third-party vendors offering prevetted RIA compliance software solutions. These vendors typically offer:

- Cloud-based platform access

- Dedicated compliance experts

- Support from compliance consultants

- Seamless onboarding and data migration

- Up-to-date rule tracking

This partnership helps firms stay current without dedicating in-house teams to every regulatory shift.

Future-Proofing Your Compliance Program

As the investment advisory industry grows, so do regulatory pressures. A scalable RIA compliance solution ensures your compliance program can grow with your firm, whether you’re managing 20 or 2,000 client accounts.

With regulators focusing more on risk-based examinations, having robust compliance management technology is no longer optional. It’s part of building a resilient, future-proof business.

Final Thoughts

From managing disclosures to meeting filing deadlines and preparing for audits, RIA compliance software does far more than you see on the surface. It powers your entire compliance process, protects your firm, and helps you stay ahead of an evolving regulatory landscape.

If your firm is still relying on spreadsheets and email threads, it may be time to explore a smarter compliance platform. One designed to help you manage risk, maintain transparency, and stay compliant with confidence.

Want to simplify your compliance?Request a Demo