Respond to regulatory exams with poise not panic.

Say goodbye to last-minute evidence gathering scrambles. Transform regulatory exams from stressful fire drills into a confident, systematic process that clearly demonstrates your compliance program’s effectiveness.

Face regulatory scrutiny with peace of mind.

Getting ready for a regulatory exam feels like cramming for a massive test – except the material covers years of compliance decisions and procedures across hundreds of controls. Most compliance teams end up digging through endless emails, hunting down documentation, and losing sleep wondering if they’ve missed something important.

The pressure gets even higher when examiners start asking follow-up questions about decisions made months or years ago, and you need to reconstruct the full context of why certain controls were put in place.

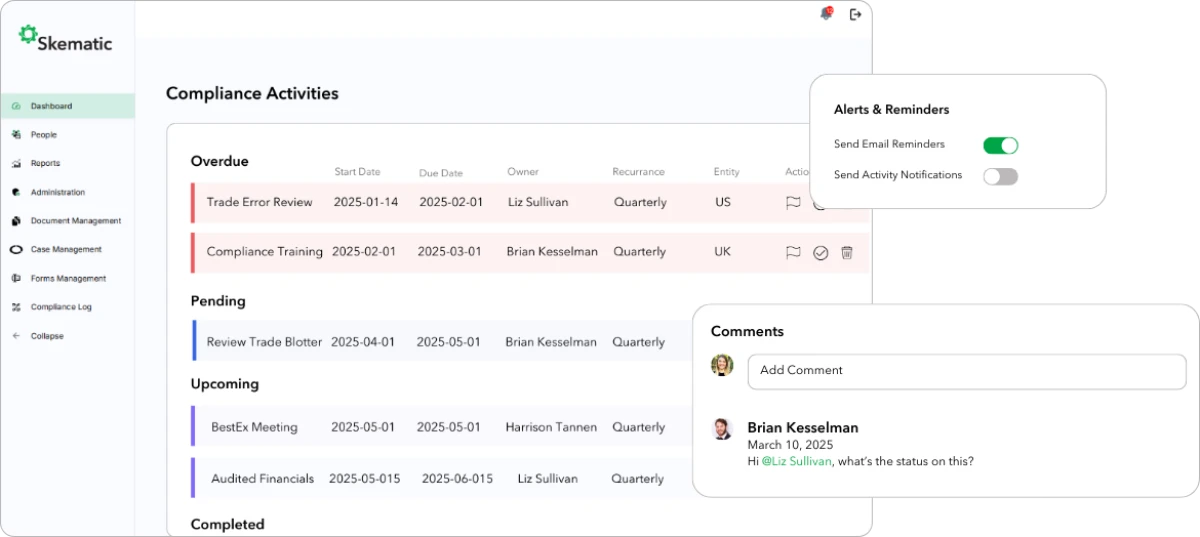

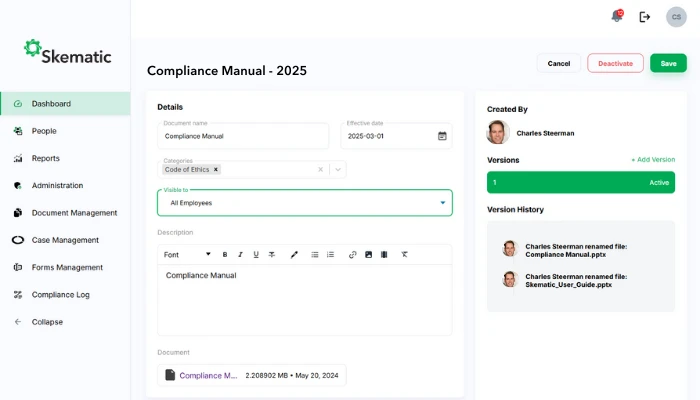

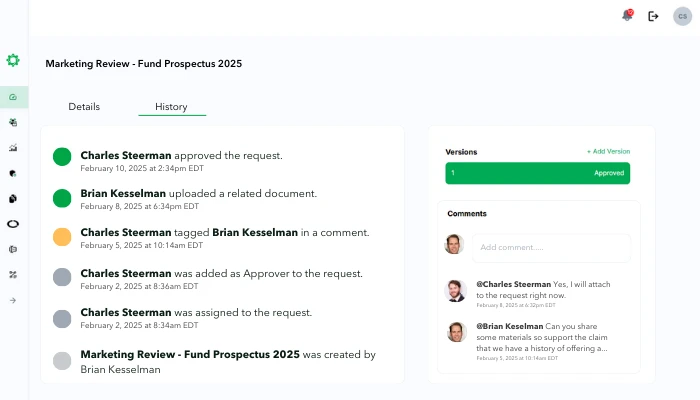

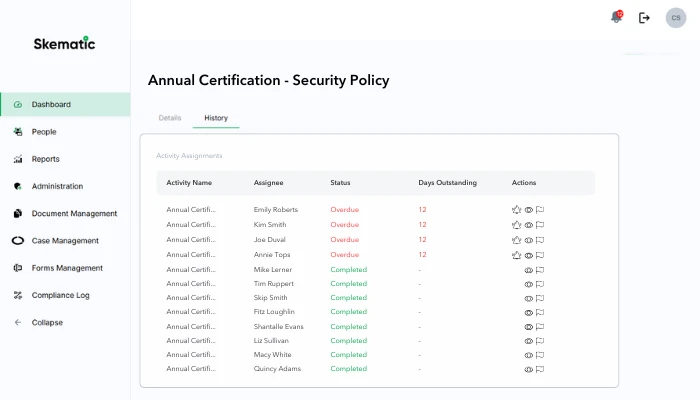

Skematic makes exam prep straightforward by capturing the details of your compliance program as they unfold. Instead of scrambling when examiners announce their visit, you’ll have everything organized and ready to show. Every policy change, procedure, compliance violation, or control update is documented with its full context automatically.

You can focus on highlighting how well your compliance efforts work instead of just trying to gather basic evidence during a compliance audit. When regulatory bodies dig deeper with questions, you’ll have the complete history of your organization’s adherence at your fingertips.

Always be examination-ready

Transform scattered compliance records into organized, accessible evidence. Replace last-minute document gathering with a systematic approach to maintaining examination-ready documentation.

- Complete compliance activity histories

- Organized requirement mapping

- Searchable policy archives

- Structured control documentation

Clear control systems

Transform program monitoring into demonstrable oversight. Show regulators how your compliance systems operate with clear evidence of consistent supervision and testing.

- Comprehensive testing records

- Exception handling documentation

- Review completion evidence

- Risk assessment tracking

Confidence under review

Transform regulatory responses from stressful scrambles into organized submissions. Quickly locate and compile evidence of your compliance program in action.

- Activity timeline exports

- Control effectiveness records

- Cross-team response coordination

- Complete compliance audit histories

/

Skematic FAQs

Most firms can fulfill common document requests within hours or even minutes using Skematic’s reporting exports. Our platform maintains organized, examination-ready documentation that’s instantly accessible when regulators come calling.

Turn compliance audits into an opportunity to shine.

Join 200+ firms who’ve transformed regulatory compliance reporting from a source of stress into a demonstration of program strength. See how Skematic can revolutionize your examination readiness while strengthening your risk management.

In the financial services industry, regulatory obligations encompass a wide range of required filings and disclosures. For investment advisers, this includes financial reporting through Form ADV annual updates and amendments, Form PF for private fund advisers, 13F holdings reports, and suspicious activity reports (SARs). To meet regulatory requirements, broker-dealers must file FOCUS reports, Rule 17a-5 annual reports, and various FINRA disclosures. Modern compliance officers use platforms like Skematic to streamline these reporting processes by maintaining audit documentation and automated workflows that ensure accuracy and timeliness.

The challenge isn’t just completing these reports – it’s maintaining the supporting documentation that validates their accuracy. Skematic’s integrated approach connects internal business processes directly to regulatory compliance obligations, creating automatic documentation that proves the completeness and accuracy of your filings while helping prevent data breaches.