Transform your broker-dealer compliance program with the first compliance OS.

Skematic’s compliance solutions help broker-dealers reduce administrative burdens while strengthening regulatory controls. Whether you’re managing institutional trading, retail brokerage, or investment banking activities, Skematic provides the operational clarity needed for regulatory excellence.

/

Broker-dealer compliance simplified.

Compliance operations

- Trade surveillance workflow management

- Branch office supervision tracking

- Account opening review processes

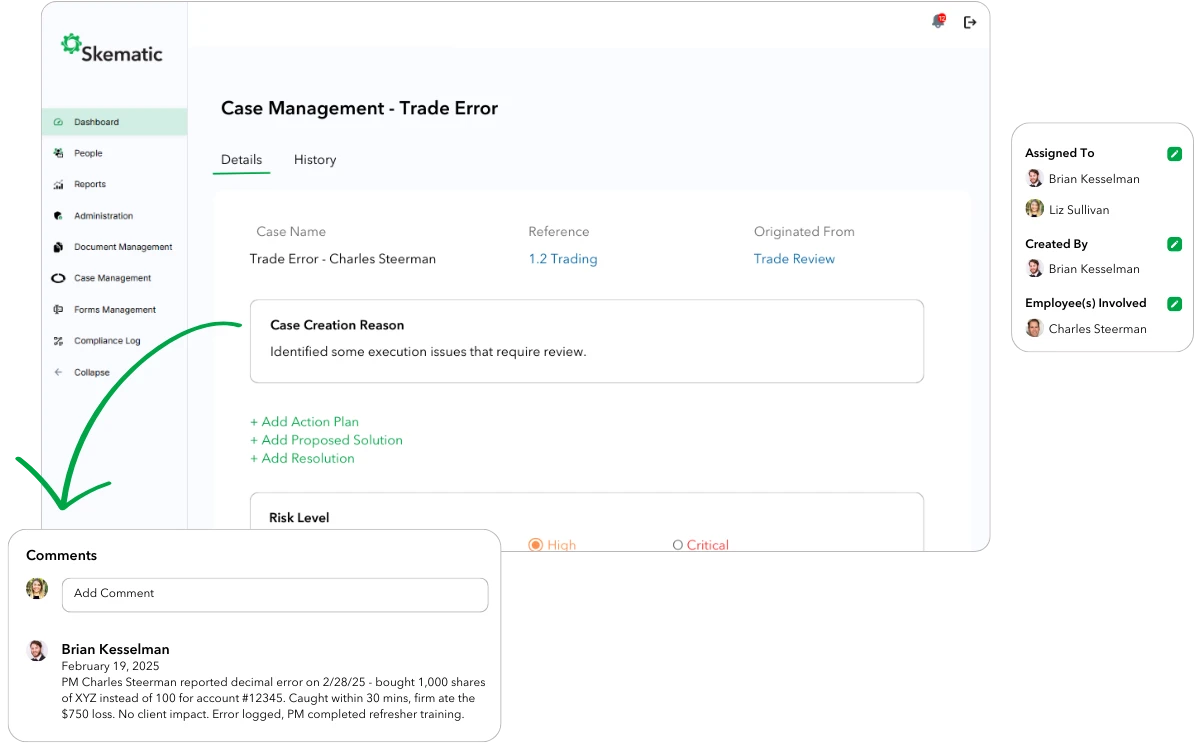

- Best execution case management

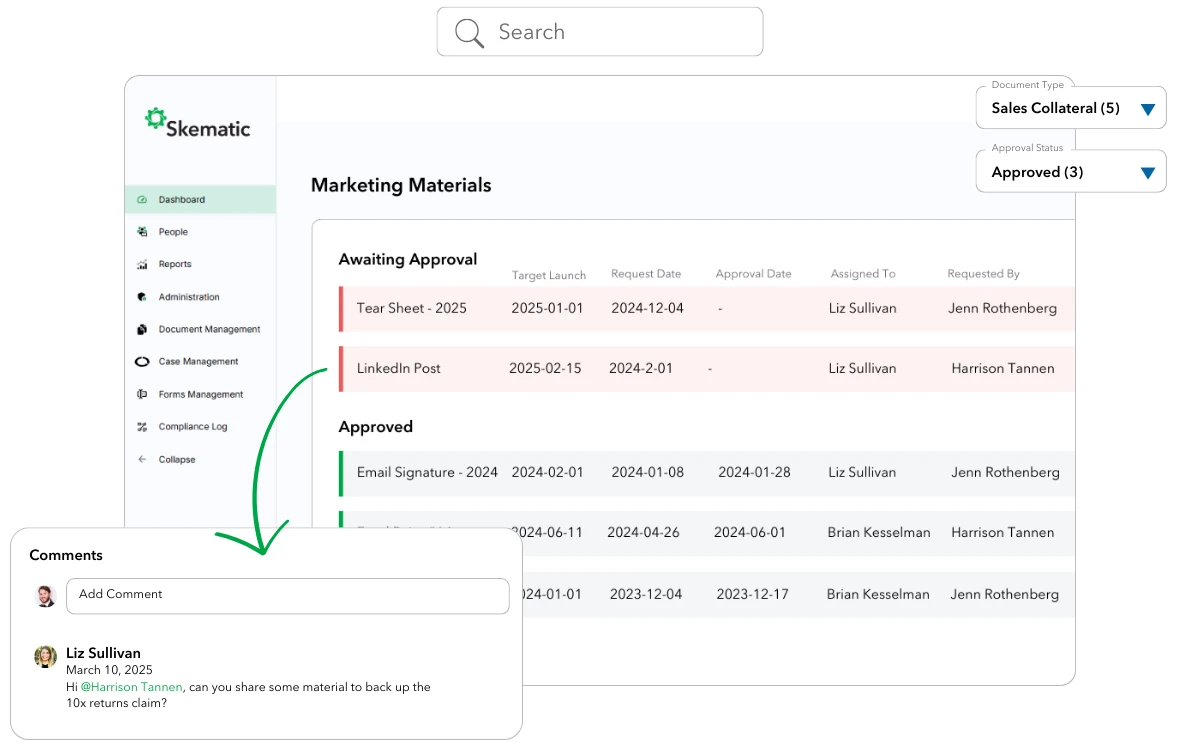

- Marketing and advertising review

- Outside business activity tracking

- Transaction reporting oversight

Examination readiness

- Comprehensive audit trails

- Risk assessment documentation storage

- Supervisory controls testing receipts

- Annual compliance meeting records

The Skematic advantage for broker-dealers

Skematic understands the unique risks and challenges faced by SEC- and FINRA-registered broker-dealers.

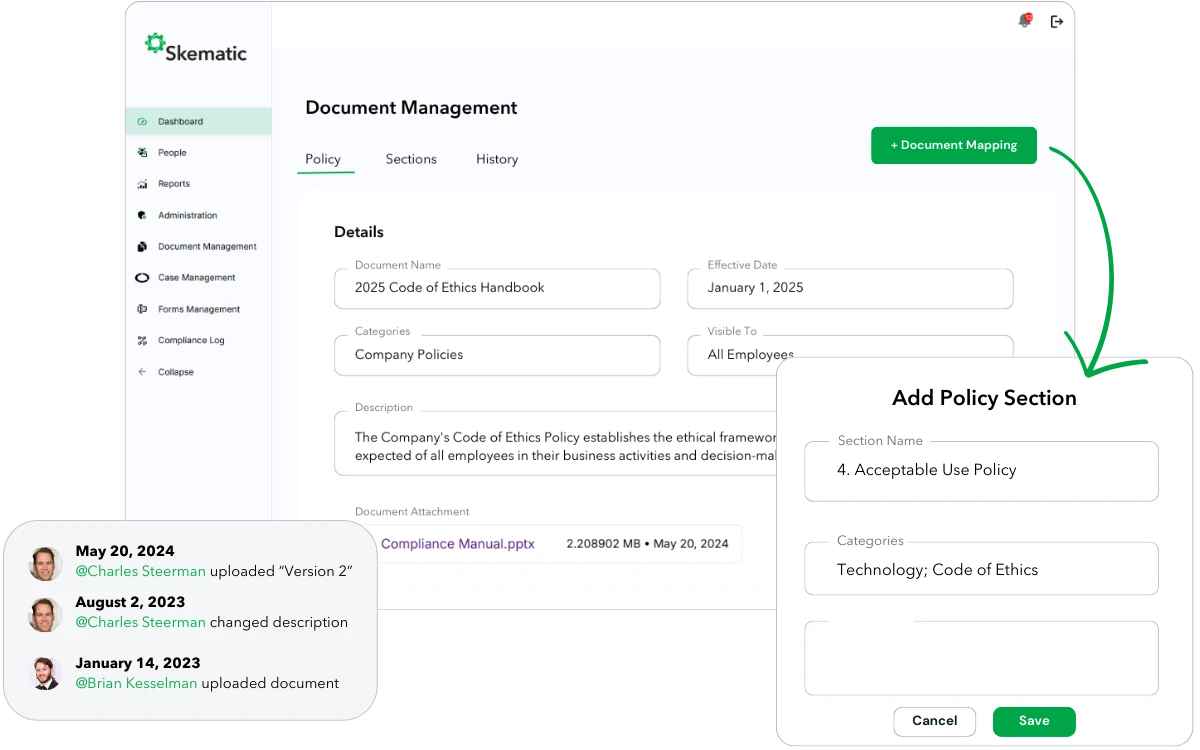

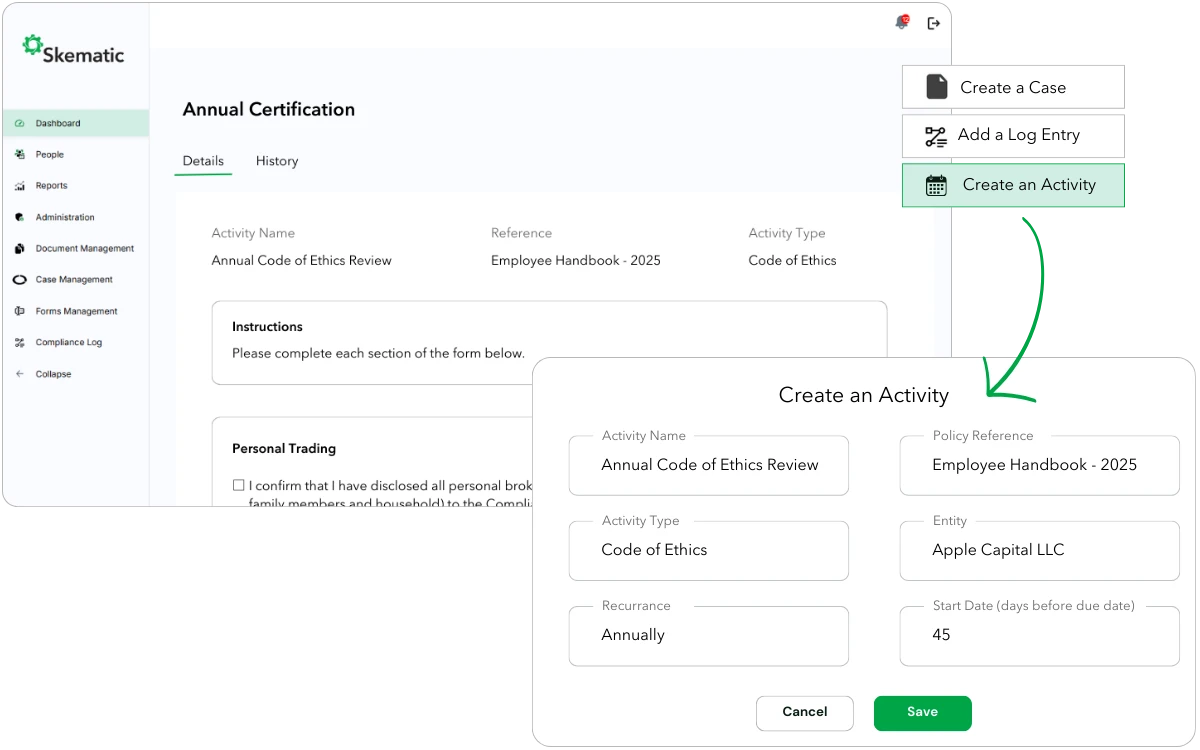

From maintaining supervisory obligations to documenting trade surveillance activities, our platform transforms manual compliance processes into streamlined digital workflows that help you meet your regulatory requirements.

Reduce administrative burden

- Cut manual compliance work by up to 75%

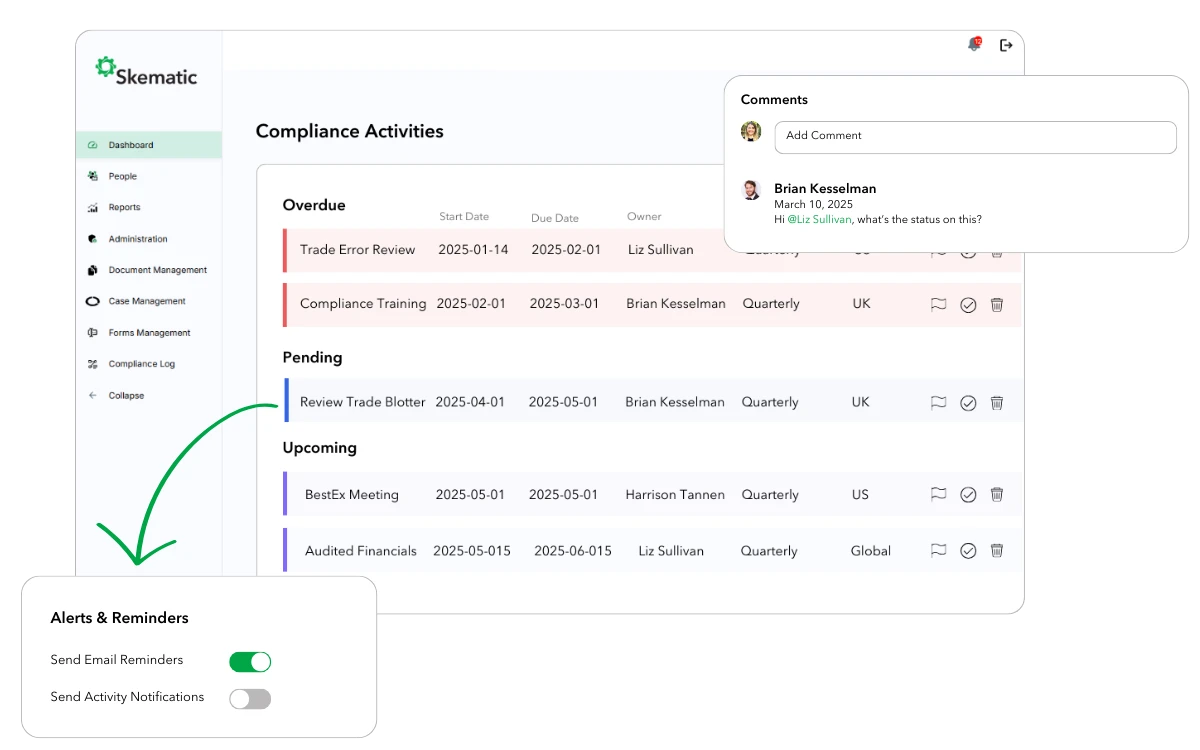

- Automate recurring compliance tasks

- Streamline approval workflows

- Centralize compliance documentation

- Eliminate repetitive data entry

- Reduce email communication by ~50%

Comply with confidence

- Complete supervisory audit trails

- Real-time compliance monitoring

- Automated deadline tracking

- Policy-linked workflows

- Risk-based testing programs

- Exception management tracking

Scale operations

- Support growing transaction volume

- Manage compliance for multiple business lines

- Standardize processes firm-wide

- Flexible workflow automation

- Custom reporting capabilities

- Quick response to regulatory inquiries

Skematic multitasks as much as you. All from one place.

Implementation and support

White-glove implementation

Our expert team handles the entire setup process, providing you with a custom-built system in a matter of weeks.

- Review your existing compliance materials

- Configure your custom Skematic instance

- Import historical compliance data

- Train your team on the platform

- Provide ongoing support and optimization

Dedicated services team

Customer satisfaction is our top priority. That’s why every Skematic subscription includes:

- Direct access to our team of compliance experts

- Regular check-ins

- Best practice guidance

- Rapid <24 hour response to inquiries

- No ticketing system barriers

Ready to transform your broker-dealer’s compliance program?

Replace spreadsheets, emails, and manual checklists with a purpose-built compliance OS. Schedule a demo to see why Skematic is the leading provider of compliance solutions for broker-dealer program management.

Industry 101

Broker dealer compliance software needs have evolved significantly as firms face increasingly complex regulatory requirements. The ideal solution should provide one platform that combines workflow automation, disclosure management, and surveillance capabilities.

While some securities firms use multiple systems, leading brokerage firms are adopting comprehensive solutions that help compliance officers centralize program management while reducing human error. These integrated platforms enable compliance teams to efficiently manage vast amounts of data while facilitating better decision making through advanced analytics.

Modern compliance software should include robust tools for monitoring communications, tracking suspicious activity, and maintaining detailed audit trails during regulatory exams. Compliance consultants frequently recommend solutions that offer customizable workflows to align with each firm’s written supervisory procedures, ensuring all compliance tasks are properly documented according to established protocols.