Code of Ethics software that finally works the way you do.

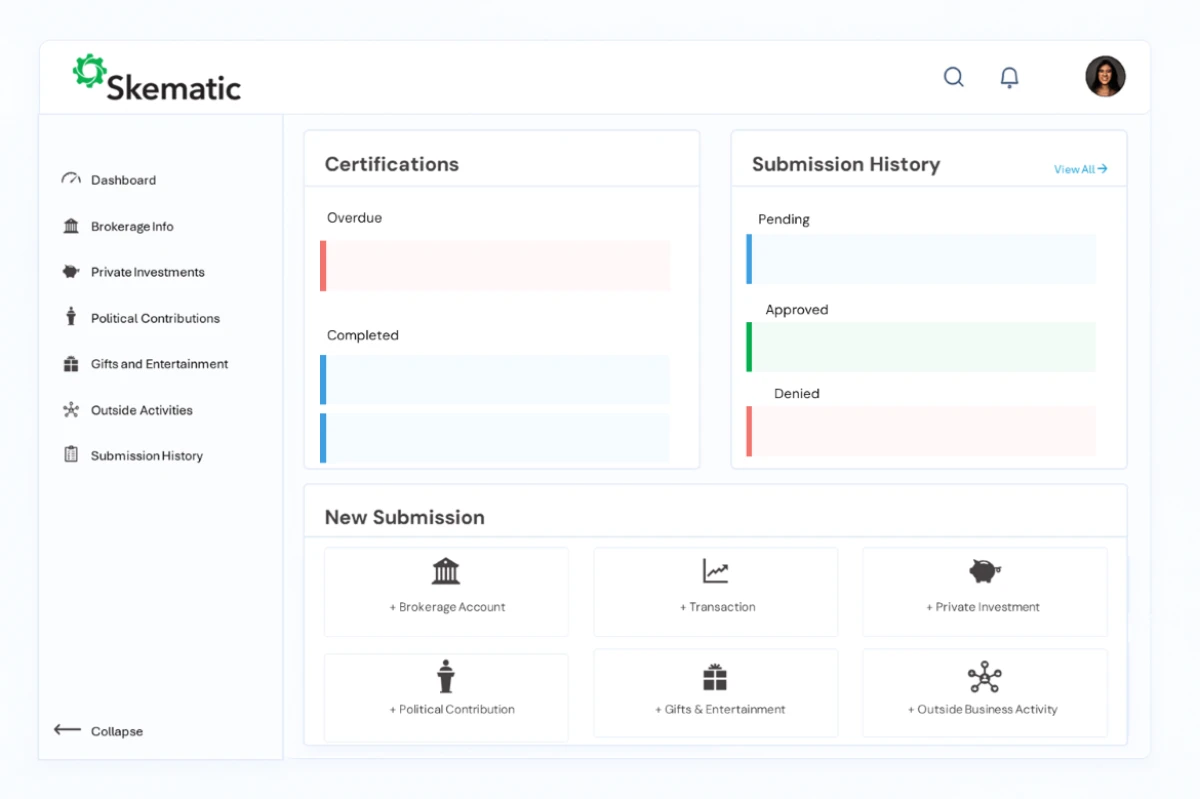

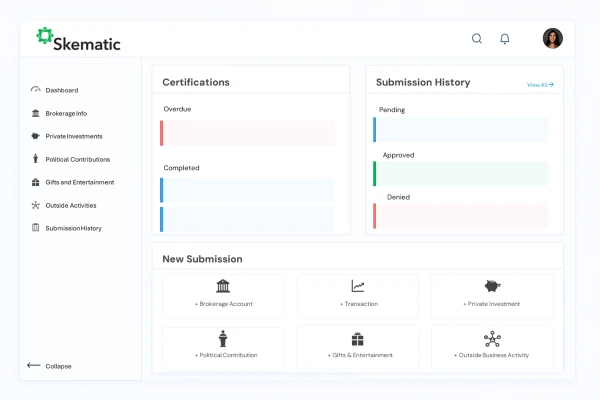

Skematic modernizes employee compliance with direct broker APIs, automated workflows, and a modern interface your team will actually enjoy using. Manage preclearance, disclosures, certifications, and trade monitoring — all in one unified, audit-ready system.

30+ years of lessons learned in one revolutionary platform.

Built by the team behind the first generation of RegTech, Skematic re-architects employee compliance for today’s expectations — reliable feeds, intuitive UX, faster oversight, and the flexibility to evolve as regulations and firm structures change.

Your Code of Ethics program finally runs in one place — accurate, automated, and employee-friendly.

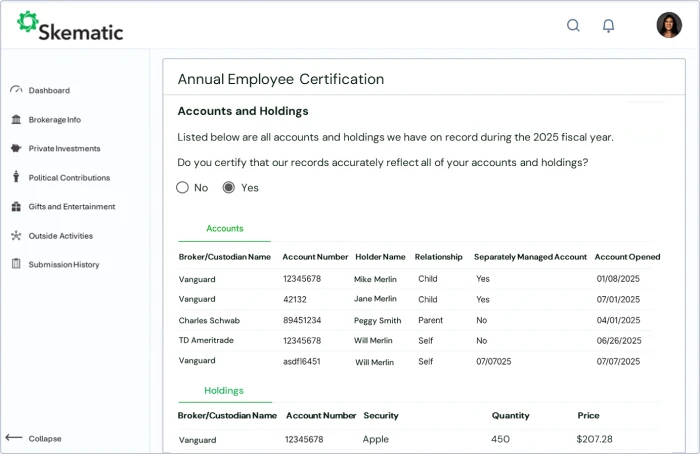

Ensure every certification is completed — on time, every time.

No chasing. No spreadsheets.

- Configurable templates aligned to company policies

- Automated reminders and tracking dashboards

- Digital signatures and immutable records

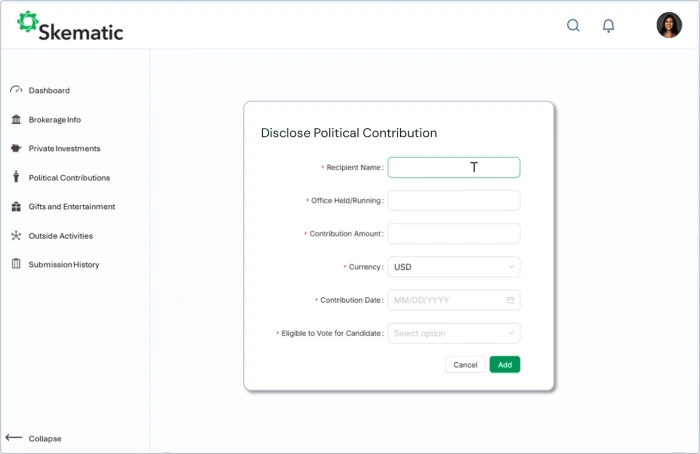

Speed up approvals without sacrificing control.

One place for every request, every approval, every record.

- Custom forms for trading, OBAs, G&E, private placements, and political contributions

- Configurable workflows to auto-approve or deny that mirror your company policies

- Automated routing for single- or multi-step approvals

- Detect potential conflicts of interest before they become compliance concerns.

- Centralized logs with full version history

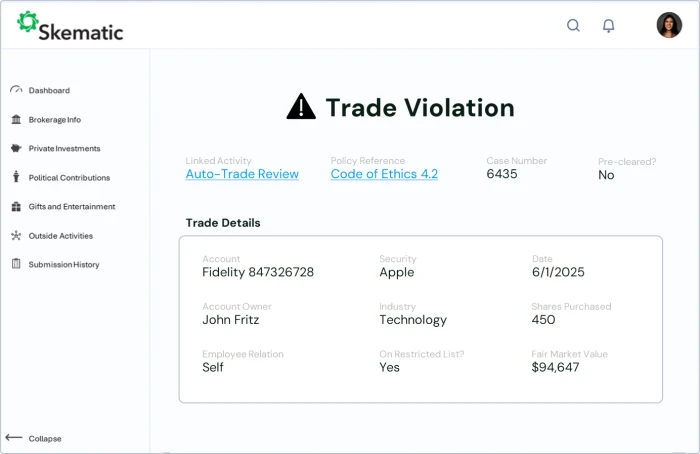

Trade monitoring that actually works — and keeps working.

No broken feeds. No manual fixes. No surprises.

- Continuous data feeds via direct APIs with brokers

- Automatic historical data import on connection

- Real-time alerts and exception tracking

If Your Employee Compliance Platform Is Old Enough to Drive, It’s Probably Time for an Upgrade

Why Skematic

Skematic

Direct API connections provide continuous, reliable data with automatic reconciliation and historical trade import.

Clean, modern interface employees actually enjoy using — guided forms, clear statuses, and seamless mobile access.

Easily create and edit forms, workflows, and approval paths — no vendor intervention required.

Modern architecture eliminates overhead — more capabilities for the same or less cost.

Continuous product evolution with new features, integrations, and automation rolled out regularly.

Go live in 4 weeks with guided onboarding — minimal IT lift required.

Hands-on service from compliance experts who sat in the compliance seat.

Legacy Vendors

SFTP or OCR feeds frequently break, requiring manual fixes, backfills, and endless reconciliations.

Outdated, cluttered UI built for administrators, not end users, leading to confusion and low adoption.

Static templates and rigid logic; changes require tickets, fees, or lengthy turnaround times.

Enterprise pricing inflated by legacy maintenance and technical debt.

Slow release cycles and minimal enhancements due to outdated infrastructure.

Multi-month deployments with heavy IT involvement and vendor dependency.

Reactive, ticket-based support with limited industry understanding and long response times.

Deceptively Simple for Employees.

The best compliance systems don’t just make life easier for compliance officers — they make it effortless for employees to do the right thing. Skematic was built with that principle at its core. Behind the scenes, powerful automation and dynamic rules handle the complexity. Front and center, employees experience a clean, intuitive interface that guides them through each step — no training required.

✅ Higher adoption and stronger compliance culture

✅ Fewer errors and reduced compliance risks

✅ Less time spent answering the same questions

Modern technology means meaningful advantages.

API Broker Feeds

Skematic connects directly with brokers through secure, modern APIs, not fragile SFTP or OCR feeds. That means continuous data coverage, automatic reconciliation, and no more broken connections to chase down.

When employees link their accounts, historical trade data pulls in automatically, so you’re never starting from a blank slate. Connections use the same technology trusted by tools like Venmo and TurboTax, ensuring a seamless experience while Skematic never stores any login details.

Sophisticated Rules Engine

At the core of Skematic is a flexible, intelligent rules engine designed to handle everything from simple preclearance policies to complex multi-entity hierarchies. Once configured, it automates approvals, alerts, and escalations — enforcing your policies consistently without the need for manual oversight. And as your firm evolves, your rules evolve with you: adjust workflows and conditions with ease, no code or vendor intervention required.

Best-in-Class Securities Master

Skematic’s rules engine is powered by FactSet’s market-leading securities data, giving you the accuracy and granularity needed for confident oversight. Every rule fires against up-to-date classifications across all asset types, ensuring restricted lists, issuer relationships, and ownership thresholds are captured correctly. The result is a smarter, more dependable surveillance process built on trusted, institution-grade data that reduces legal penalties and strengthens your compliance management framework.

They built it first. We built it better.

Skematic is everything the old guard got right — plus everything it couldn’t.