Ensure compliance with the Marketing Rule.

The SEC Marketing Rule has made financial service advertising much trickier than before. Now every social post, performance claim, and client testimonial needs careful review and approval. The old method of passing everything through email creates bottlenecks and leaves gaps in your compliance records. Marketing teams get frustrated waiting for approvals while compliance teams struggle to keep up with request volume and maintaining adequate documentation.

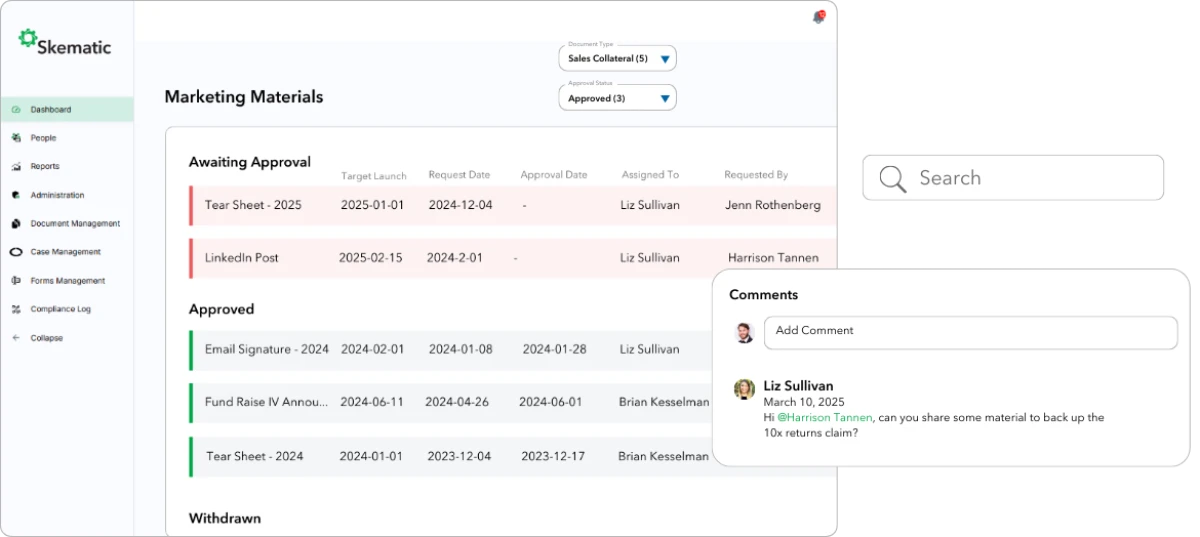

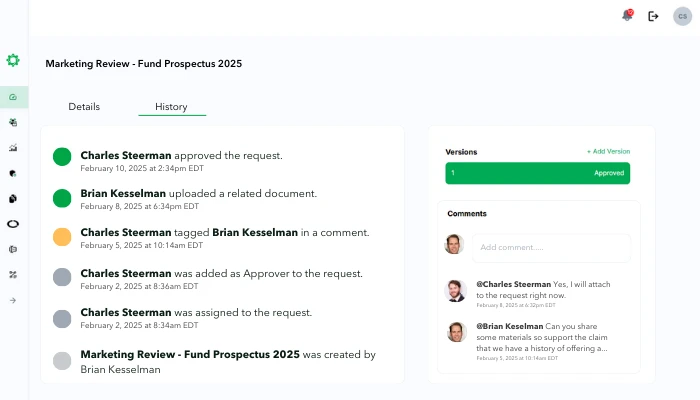

Skematic gives marketing, legal, and compliance teams one place to work together on collateral and campaign reviews. Comments, approvals, and changes are all documented as you go, so marketing can move quickly while you can ensure compliance. The platform helps spot potential issues early in the process, reducing review cycles. Plus, you’ll have clear evidence of your review process ready for regulators, showing how your team evaluates and approves marketing materials.

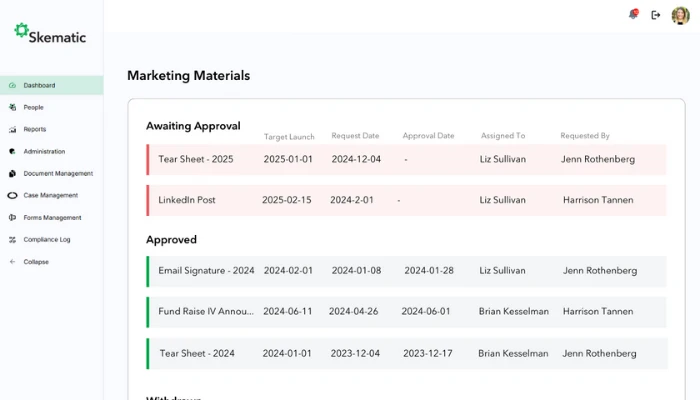

Find any approved asset in seconds.

Store all marketing materials (documents, collateral, audio files, links, ads etc.) in a searchable repository so marketing can spend less time looking for the compliant version.

- Customizable document organization

- Ability to add comments and tag users

- Collateral expiration date monitoring

Efficient marketing compliance reviews.

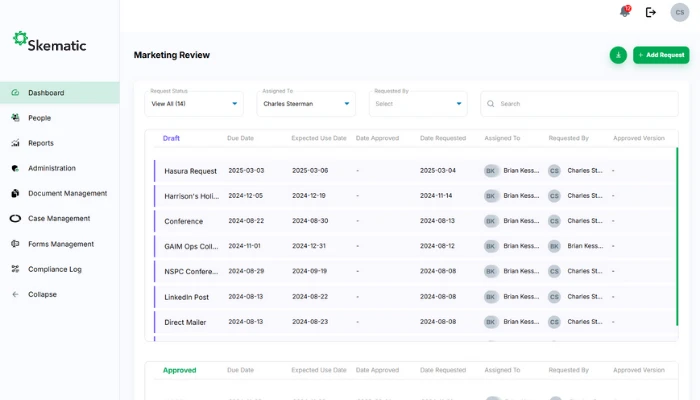

Transform manual processes into streamlined workflows that ensure consistent compliance review and documentation, while improving efficiency.

- Custom approval sequences

- Structured role-based review routing

- Historical review reference

- Automated report generation

Stay compliant with confidence.

Utilize purpose-built features designed to help you master the SEC Marketing Rule requirements and reduce risk across the business:

- Comprehensive checklists for testimonials and endorsements

- Clear documentation of compliance with core prohibitions

- Automated tracking of compliance and legal review timelines

- Complete reports of recordkeeping and audit trails

Turn functional silos into shared workspaces.

Replace endless email chains during the marketing compliance review process with a centralized platform where various departments teams work together as partners to secure approvals.

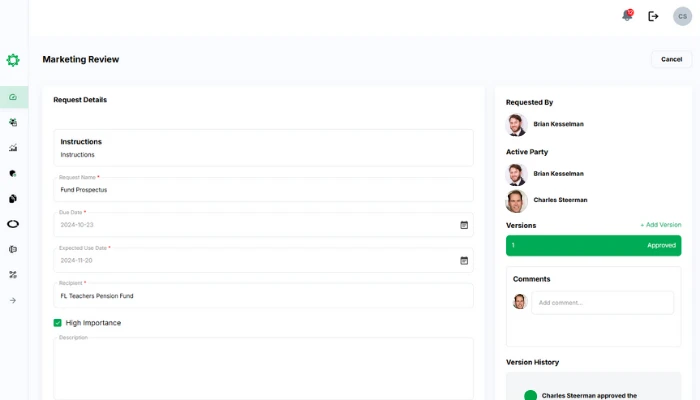

- Real-time collaboration across departments (i.e. marketing, compliance and legal teams)

- Custom compliance review checklists

- Clear version tracking and comparison

- Automated notifications and reminders

- In-platform comments and user tagging

Skematic FAQs

Pricing for Skematic’s end to end Compliance OS starts at $5,000 per year for businesses of all sizes. Our platform provides exceptional value for companies seeking comprehensive compliance solutions.

Click here to see detailed packages, including upgrade options to include the Marketing Materials Review solution that many of our partners have found invaluable for their operational needs.

Upgrade Your Marketing Materials Review Process

Join 200+ firms who’ve turned marketing compliance from a bottleneck into a streamlined process. See how Skematic can help your firm spend less time on the advertising review and approval process while strengthening Marketing Rule compliance.

Marketing compliance in the financial services industry requires companies to ensure all marketing materials and business communications meet regulatory requirements and industry standards.

This critical activity encompasses reviewing ad campaigns, collateral, website content, and social media posts to protect consumers from misleading information. For example, investment advisers must carefully document performance claims with appropriate disclosures.

Skematic’s technology provides a streamlined methodology by enabling marketing teams, lawyers, and compliance partners to collaborate efficiently on reviews and approvals, drawing upon our deep knowledge of regulatory expectations.