Registered investment adviser compliance simplified.

Skematic’s compliance solutions help registered investment advisers reduce administrative burdens while strengthening regulatory controls. Whether you’re managing institutional assets, private funds, or individual wealth, Skematic provides the operational clarity needed for regulatory excellence.

/

Supporting firms of all types and strategies:

Private Equity

Hedge Funds

Venture Capital

Mutual Funds

Wealth Management

Investment Advisers

The Skematic advantage for RIAs

Skematic understands the unique risks and challenges faced by SEC-registered investment advisers. From maintaining regulatory obligations to documenting fiduciary responsibilities, our platform transforms manual compliance processes into streamlined digital workflows that help you meet your regulatory requirements.

Reduce Administrative Burden

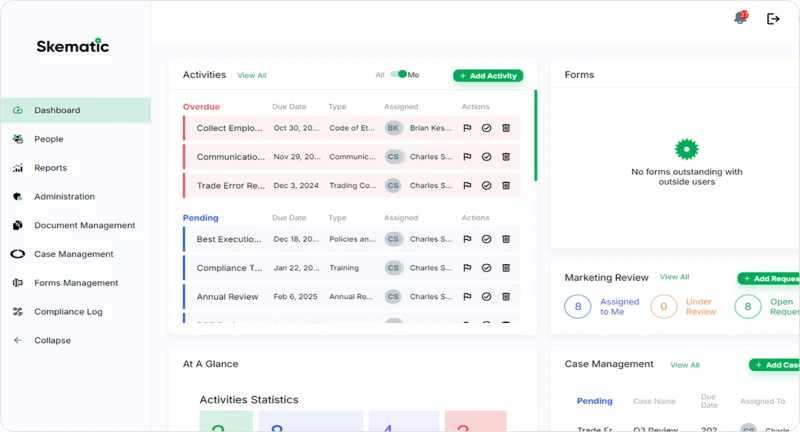

- Cut manual compliance work by up to 75%

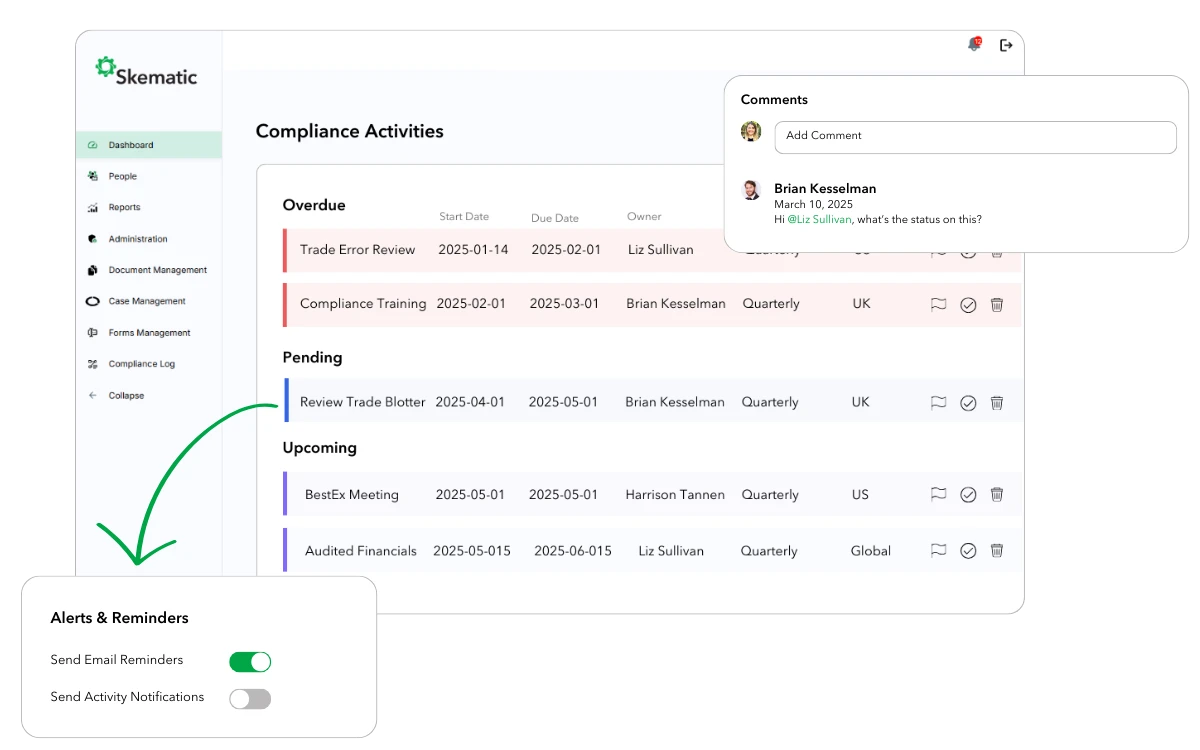

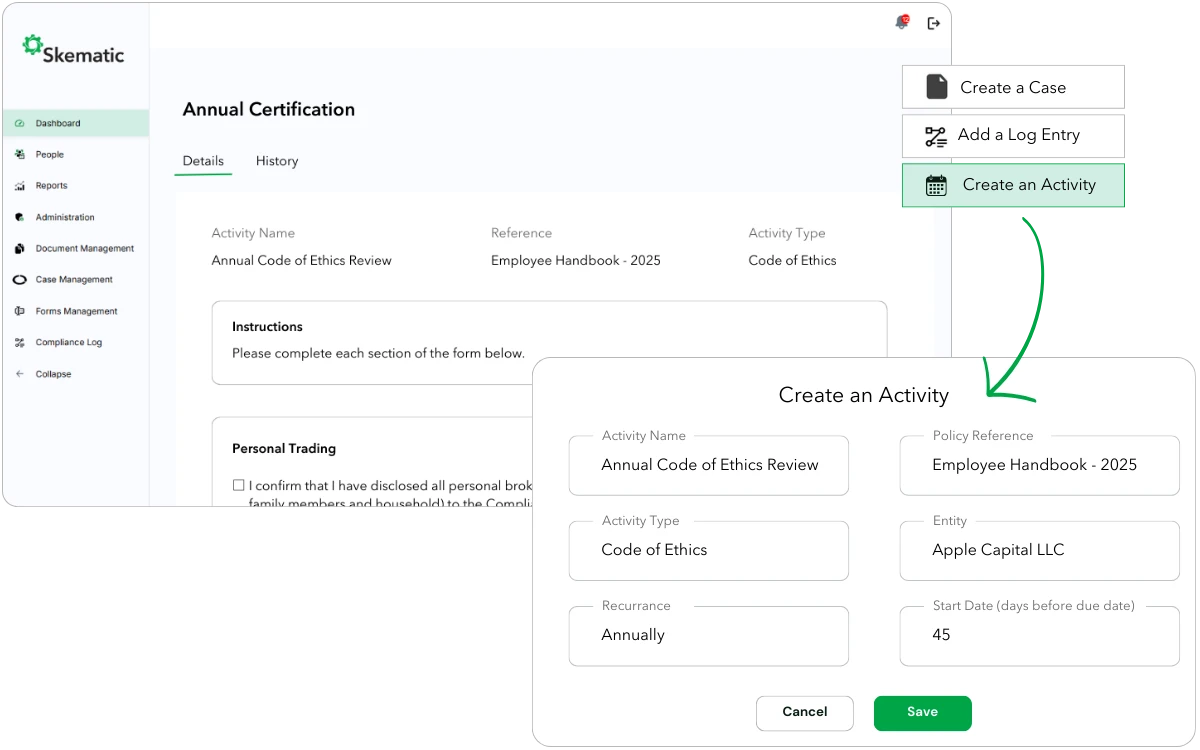

- Automate recurring compliance tasks

- Streamline approval workflows

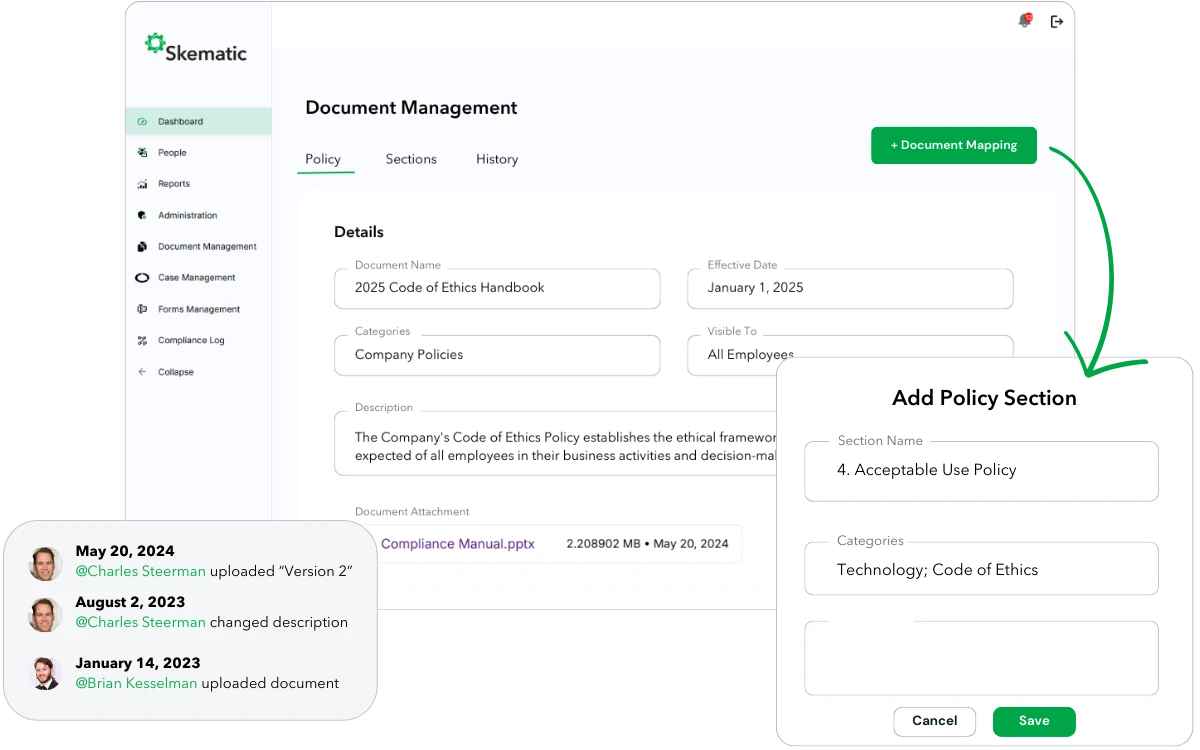

- Centralize compliance documentation

- Eliminate repetitive data entry

- Reduce email communication by ~50%

Comply with Confidence

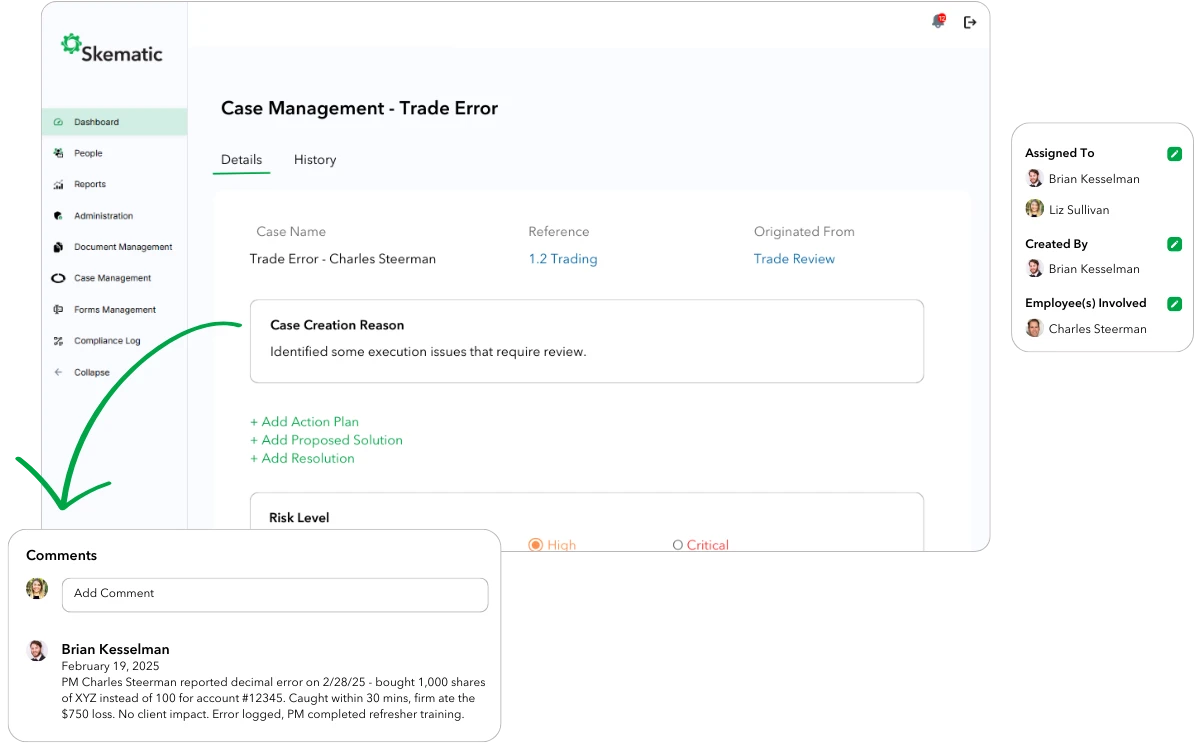

- Comprehensive audit trails

- Real-time compliance monitoring

- Automated deadline tracking

- Policy-linked workflows

- Risk-based testing programs

- Exception management tracking

Scale Operations

- Support growing AUM

- Centralize compliance for multiple investment strategies

- Standardize processes firm-wide

- Flexible workflow automation

- Custom reporting capabilities

- Quick response to regulatory inquiries

Implementation and support

White-glove implementation

Our expert team handles the entire setup process, providing you with a custom-built system in a matter of weeks.

- Review your existing compliance materials

- Configure your custom Skematic instance

- Import historical compliance data

- Train your team on the platform

- Provide ongoing support and optimization

Dedicated services team

Customer satisfaction is our top priority. That’s why every Skematic subscription includes:

- Direct access to our team of compliance experts

- Regular check-ins

- Best practice guidance

- Rapid <24 hour response to inquiries

- No ticketing system barriers

Comprehensive RIA compliance management

Compliance operations

- Compliance program management & monitoring

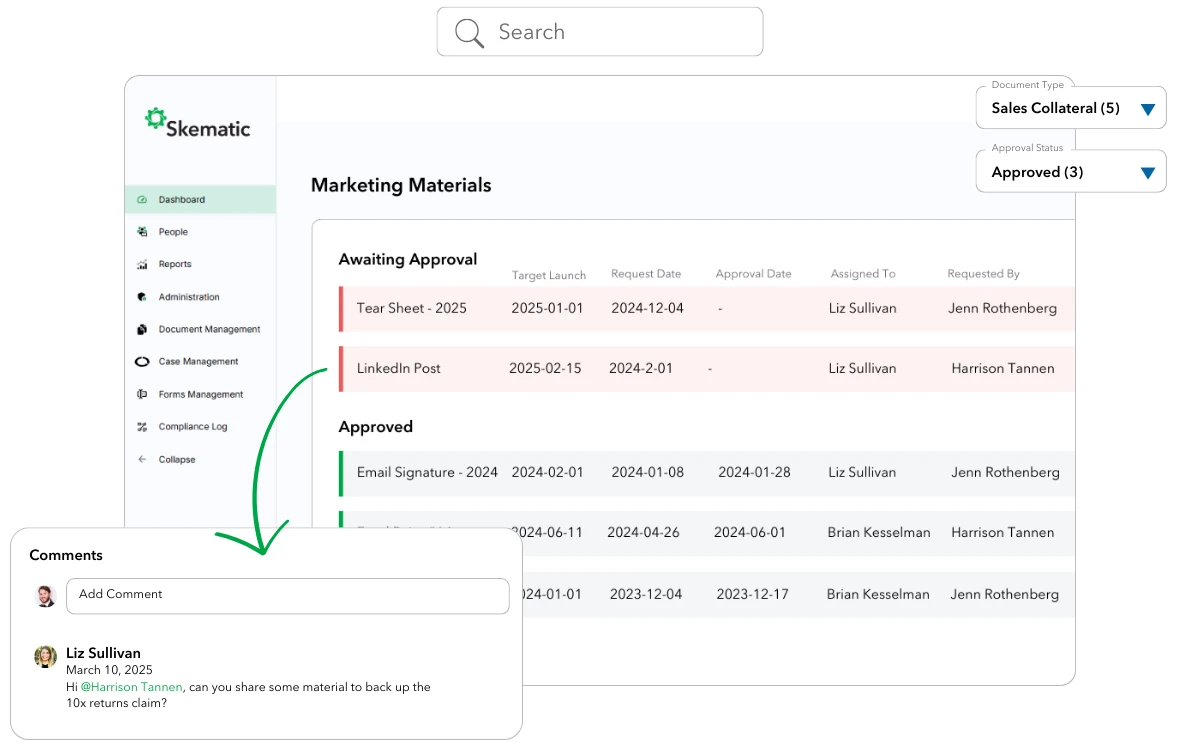

- Marketing and advertising review workflows

- Side letter agreement tracking

- Third party vendor contract management

- Annual client review tracking

- Employee certification administration

Examination readiness

- Comprehensive audit trails

- Annual review workflows

- Risk assessment storage

- Regulatory exam preparedness

In the evolving compliance landscape, with the private fund rule and new regulations constantly emerging, we realized we needed more than spreadsheets, Word documents, and Outlook calendar reminders. Skematic provided the centralized solution we needed.

Skematic multitasks as much as you. All from one place.

Transform your RIA compliance program with the only regulatory compliance OS.

Replace spreadsheets, emails, and manual checklists with a purpose-built compliance OS. Schedule a demo to see why Skematic is the leading provider of compliance solutions for program management.

Industry 101

RIA compliance encompasses the systems, policies, and procedures that SEC-registered investment advisers must maintain to meet SEC regulations and regulatory obligations. Modern firms utilize compliance software and compliance consultants to strengthen their compliance programs. This includes maintaining accurate books and records, implementing comprehensive security measures, conducting regular business reviews, and documenting all compliance activities.

Firms often leverage automation through services like Skematic to streamline workflows, maintain audit trails, and ensure consistent execution of compliance tasks.