Organize contracts, agreements and side letters with ease.

Organize your documentation ecosystem and strengthen compliance. Convert scattered contracts and side letters into an organized system that monitors obligations, streamlines workflows, and strengthens controls for both your funds and other investors.

Master complex obligations while reducing risk.

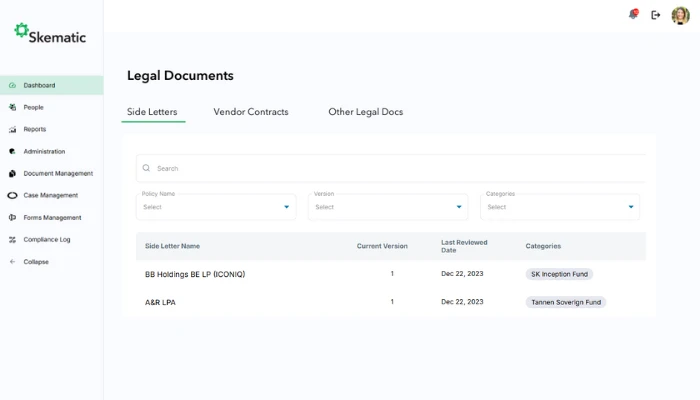

Most financial firms are juggling dozens of complex contracts: IMAs with specific investment rules, side letters with custom terms for other investors, ISDA agreements covering trading relationships. Yet somehow we’re still tracking these critical obligations with basic spreadsheets and calendar reminders that make it impossible to see how everything fits together. The real challenge hits when you need to understand how changes to one document affect others.

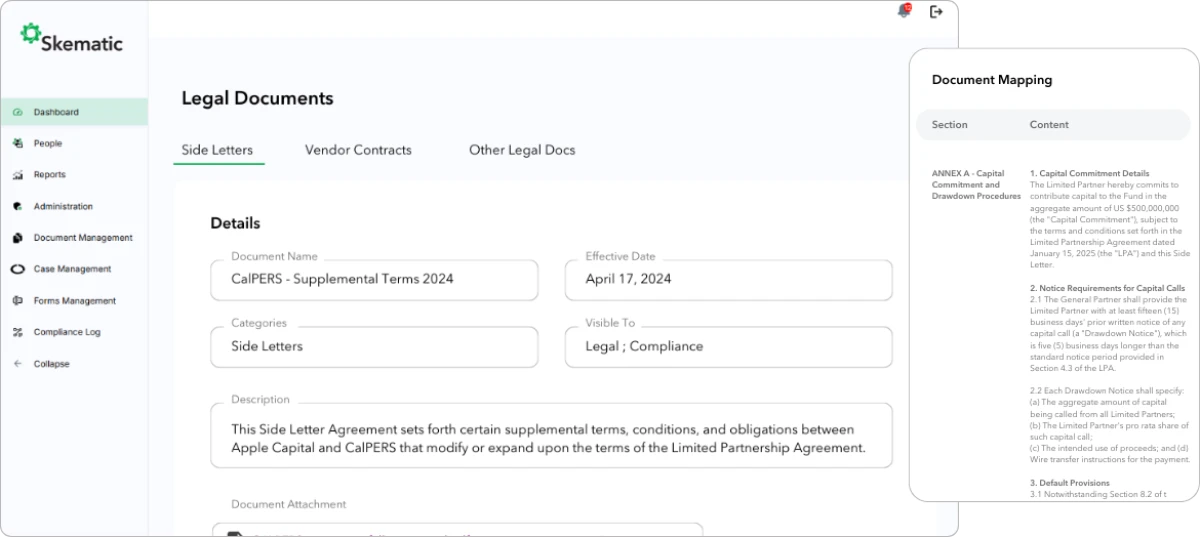

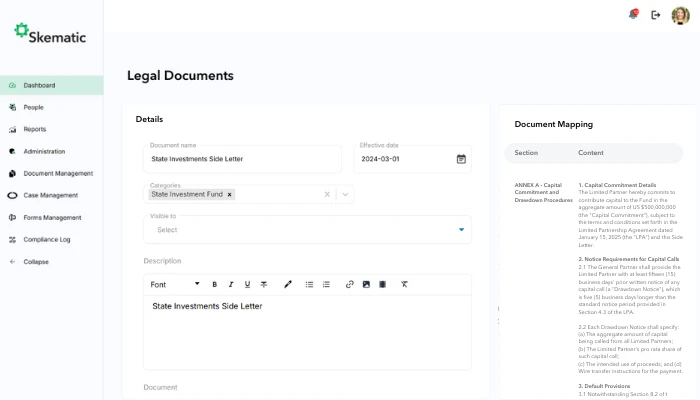

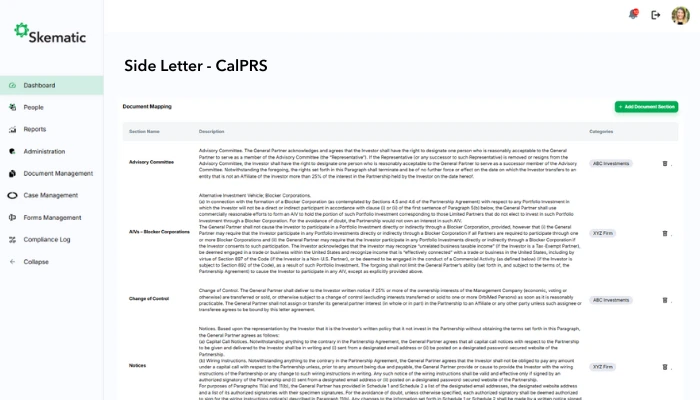

Skematic turns dense documents into clear action plans. The platform pulls out key deadlines, terms, and obligations automatically, then helps you track them for both funds and investors. Everything connects, so you can see exactly what needs to happen and when. When new agreements or side letters come in, the system helps identify overlapping obligations and potential conflicts with existing investor commitments, making it easier to stay on top of your obligations without worrying about overlooked terms in side letters or other critical documents.

Mastering legal commitments

Convert complex legal obligations into actionable tasks. Create a dynamic system that actively monitors commitments and ensures compliance with agreement terms.

- Automated obligation extraction and tracking

- Commitment monitoring with deadline alerts

- Smart indexing of each document section and requirement

- Regulatory impact assessment tools

Obligation tracking made simple

Replace manual tracking and email chains with structured workflows that keep commitments on schedule while reducing administrative work.

- Automated deadline monitoring

- Structured approval workflows

- Version-controlled collaboration

- Scheduled task assignment

- Regular stakeholder updates

Documented agreement compliance

Create a clear history of agreement management and obligation fulfillment. Every commitment tracked with complete supporting documentation.

- Term compliance evidence

- Deadline adherence records

- Obligation fulfillment proof

- Agreement status documentation

Skematic FAQs

Skematic’s platform pricing starts at $5,000 per year, with packages designed to accommodate any organization, whether you’re a small team or a global operation. Pricing for just the Legal Doc & Side Letter Manager without core Skematic starts at just $2,500.

Transform legal chaos into compliance confidence

Join 200+ firms who’ve turned legal document management from a constant challenge into a strategic advantage. See how Skematic’s agreement and side letter obligation software can simplify your agreement management while driving compliance.

Private fund managers, particularly those handling venture capital funds and investment partnerships, need systematic approaches to creating, organizing, and maintaining agreements and their associated terms. Modern investment firms are moving beyond traditional file storage toward integrated systems like Skematic that connect side letters, limited partnership agreement provisions, and compliance requirements, ensuring both new and early investors are treated equally while managing preferential treatment for one investor without increasing risk to other investors.