In today’s volatile and increasingly digital business environment, risk management is no longer a luxury, it’s a necessity. Organizations across industries face a wide range of potential risks, from cybersecurity threats and data breaches to privacy risks, operational risk, and evolving regulatory compliance standards. To stay competitive and secure, many organizations turn to a risk management framework (RMF): a structured approach for identifying potential risks, evaluating their impact, implementing risk mitigation strategies, and maintaining continuous monitoring.

Whether you’re a private business, a public institution, or one of many federal agencies, implementing an effective risk management framework can significantly strengthen your information security posture, protect your organization’s reputation, and support informed decisions that align with your business goals.

What Is a Risk Management Framework?

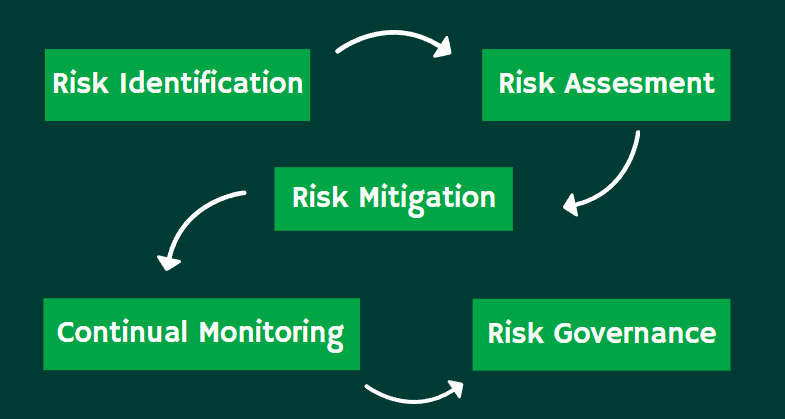

A risk management framework is a comprehensive framework that enables organizations to manage risk systematically across all departments and systems. It outlines the processes for risk identification, risk assessment, risk mitigation, and risk reporting to ensure effective risk management practices are embedded throughout the organization. This framework also supports risk governance by defining roles, responsibilities, and escalation procedures.

While multiple frameworks exist, one of the most widely recognized is the NIST Risk Management Framework, originally developed by the National Institute of Standards and Technology. Initially intended to help federal agencies secure federal information systems, it is now widely adopted in the private sector, especially among financial services, healthcare, and technology companies. Another major player is the COSO Internal Control Framework, which focuses on enterprise risk management, internal controls, and control objectives for both financial and operational activities.

These sponsoring organizations provide international standards and a common language for managing risk effectively across various industries.

Key Components of an Effective Risk Management Framework

Implementing an RMF requires a structured and repeatable risk management process. The following components are critical for success:

1. Risk Identification

Organizations must first identify potential risks that could impact business operations, information systems, or regulatory standing. These risks may include system vulnerabilities, compliance violations, privacy risks, or real-world scenarios like natural disasters and supply chain breakdowns.

2. Risk Assessment

This involves risk measurement, analyzing the likelihood and impact of each threat. Tools like impact analysis and scoring models help prioritize identified threats, providing a clear picture of where to focus mitigation efforts.

3. Risk Mitigation Strategies

After assessment, organizations must apply selected controls to reduce exposure to various risks. This may involve deploying security controls, modifying business processes, investing in information technology, or outsourcing high-risk operations. These risk mitigation efforts are central to reducing business risks and protecting organization’s capital.

4. Continuous Monitoring

Effective risk management activities are not one-and-done. Ongoing continuous monitoring is essential for detecting new threats, ensuring regulatory compliance, and adapting to changes in the environment. This includes risk reporting, internal reviews, and information systems audit procedures.

5. Risk Governance

Robust risk governance provides oversight and ensures alignment with business objectives. It involves establishing a risk committee, assigning ownership to business units, and regularly reviewing the risk management framework at the executive level to ensure accountability.

Popular Risk Management Frameworks: NIST, COSO, and Beyond

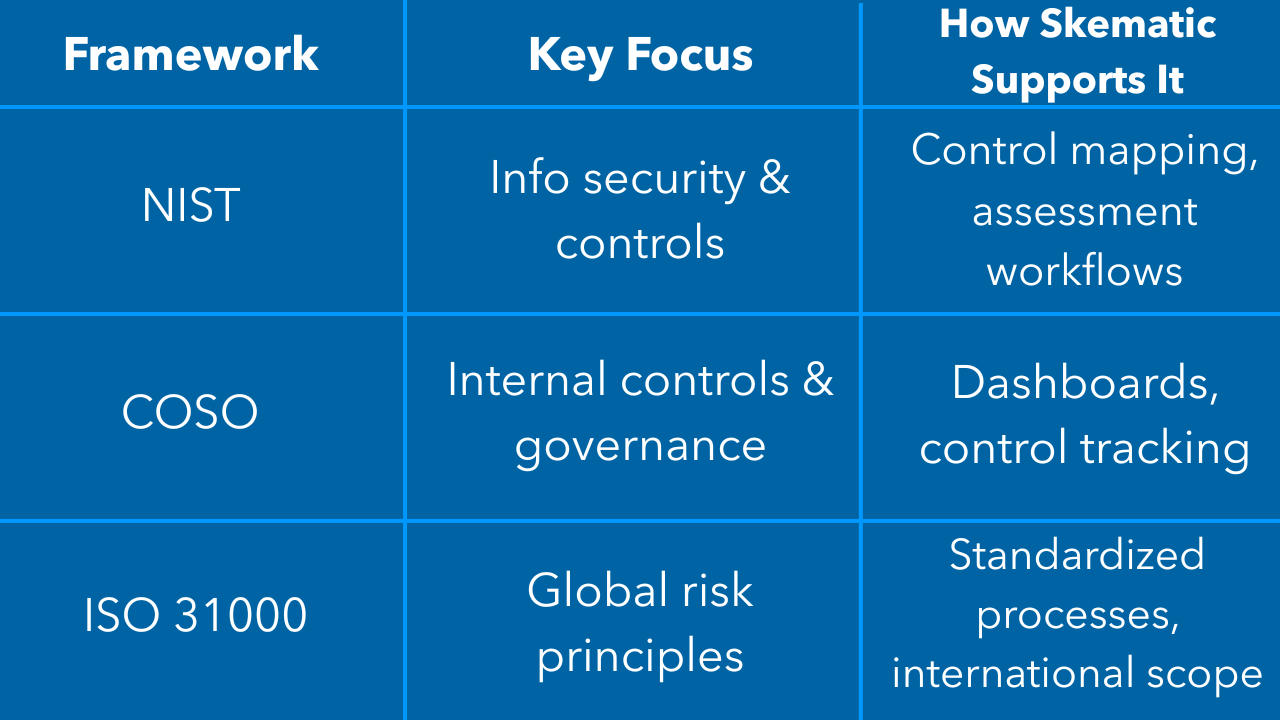

Organizations often build their risk programs around widely accepted frameworks, depending on their industry, size, and regulatory needs. Skematic’s flexible platform is designed to align with these standards, making implementation and monitoring easier at scale.

- NIST Risk Management Framework (RMF): Common in the public sector, this framework emphasizes information security and protecting federal information systems. Skematic supports NIST-based risk assessment workflows and control mapping for private-sector adoption as well.

- COSO Internal Control Framework: Popular in finance and operations, COSO emphasizes enterprise risk management and internal control. Skematic enables organizations to track control objectives, assess risk appetite, and visualize governance structure through customizable dashboards.

- ISO 31000 and other international standards: For global teams, Skematic helps standardize risk management processes while supporting alignment with ISO principles and international best practices.

Whether you’re following NIST, COSO, or ISO guidelines, Skematic provides the tools to bring your risk management framework to life without the overhead of manual reporting and disconnected systems.

Why Risk Management Frameworks Matter More Than Ever

An effective risk management framework does more than just check boxes for regulatory requirements, it builds overall resilience. In a world of rising cyber threats, increased regulatory scrutiny, and complex business processes, organizations that invest in a structured risk management approach are better positioned to:

- Reduce the likelihood of costly data breaches

- Comply with laws like the General Data Protection Regulation (GDPR)

- Navigate crises with minimal disruption

- Enable secure digital transformation

- Maintain stakeholder trust and protect the organization’s reputation

Additionally, a well-implemented framework enables enabling organizations to make informed decisions, take calculated risks, and grow with confidence. In short, it’s a foundation for sustainable success.

Final Thoughts: Make Risk Management a Strategic Advantage

From the cybersecurity frameworks to custom-built models tailored for specific industries, there’s no shortage of ways to approach risk. But regardless of the framework used, the goal is the same: to anticipate, mitigate, and manage risk in a way that supports long-term performance.

For many organizations, especially those handling sensitive data or operating in highly regulated spaces, a risk management framework is not just a best practice, but it’s a strategic necessity.

By embedding these practices into everyday workflows, aligning with international standards, and investing in the right tools and governance structures, your organization can build a culture of proactive, effective risk management that supports innovation without sacrificing control.

Streamline compliance today.Request a Demo