In today’s highly scrutinized and rapidly evolving financial world, regulatory compliance for finance has become more than a legal requirement, it’s a cornerstone of trust, security, and operational integrity.

With rising threats like financial crime, cyber breaches, and tightening regulations from agencies like the Securities and Exchange Commission, the finance industry faces unprecedented pressure to stay compliant, secure, and audit-ready.

But this is not just about avoiding regulatory penalties. It’s about protecting your business, your clients, and the integrity of the financial system.

What Does Regulatory Compliance in Finance Really Mean?

Regulatory compliance refers to the frameworks, rules, and oversight requirements that financial institutions must follow to remain in good legal and operational standing.

For investment advisers, fund managers, and financial services firms, this includes areas such as:

- Code of Ethics (COE) programs and personal trading oversight

- Marketing material review and pre-approvals

- Certifications and attestations

- Task tracking for regulatory filings, disclosures, and control testing

- Requirements enforced by the Securities and Exchange Commission (SEC) and other regulatory bodies

These obligations ensure firms act in their clients’ best interests, avoid conflicts of interest, and maintain audit-ready records. Platforms like Skematic help manage these workflows efficiently, so compliance isn’t just about checking boxes—it’s built into how teams operate every day.

Why Compliance Is Business-Critical in the Finance Industry

Failing to meet compliance requirements can result in:

- Costly legal action or regulatory fines

- Damage to your brand’s reputation

- Exposure of sensitive customer data or private financial information

- Disruptions to your core financial services or capital markets operations

- Loss of investor confidence

That’s why top financial firms, investment firms, and accounting firms are investing in scalable compliance programs and modern compliance risk management strategies.

Key Areas of Financial Compliance Today

Modern financial compliance is multi-faceted. Here are some areas where financial institutions operate under increased regulatory scrutiny:

1. Anti-Money Laundering (AML)

Financial firms are required to detect suspicious activity and conduct regular risk assessments to comply with AML directives. Failing to do so puts the entire financial sector at risk.

2. Data Protection & Cybersecurity

As cyber threats rise, data security and protecting customer data are top priorities. Regulations like GDPR, CCPA, and SOX require firms to secure sensitive data and prove their ability to protect financial data and customer data during external audits.

3. Financial Reporting & Disclosures

Publicly traded and private institutions must meet strict financial reporting standards to avoid non-compliance. Inaccurate reporting can mislead investors and disrupt the broader financial markets.

4. Vendor & Third-Party Risk

Vendor management is another area under focus. Many financial institutions rely on third-party providers for services—each representing potential compliance and data protection risks.

The Role of Compliance Officers and Tools

Every firm needs a dedicated compliance officer (or team) responsible for ensuring compliance, conducting risk assessments, and leading internal compliance processes.

To support their work, institutions are investing in:

- Regulatory compliance frameworks tailored to their specific markets

- Automated monitoring systems for real-time alerts

- Data encryption and access controls for sensitive customer data

- Policies aligned with both local and international financial regulation

This shift reflects a larger trend: compliance is no longer reactive, it’s embedded directly into how financial institutions operate.

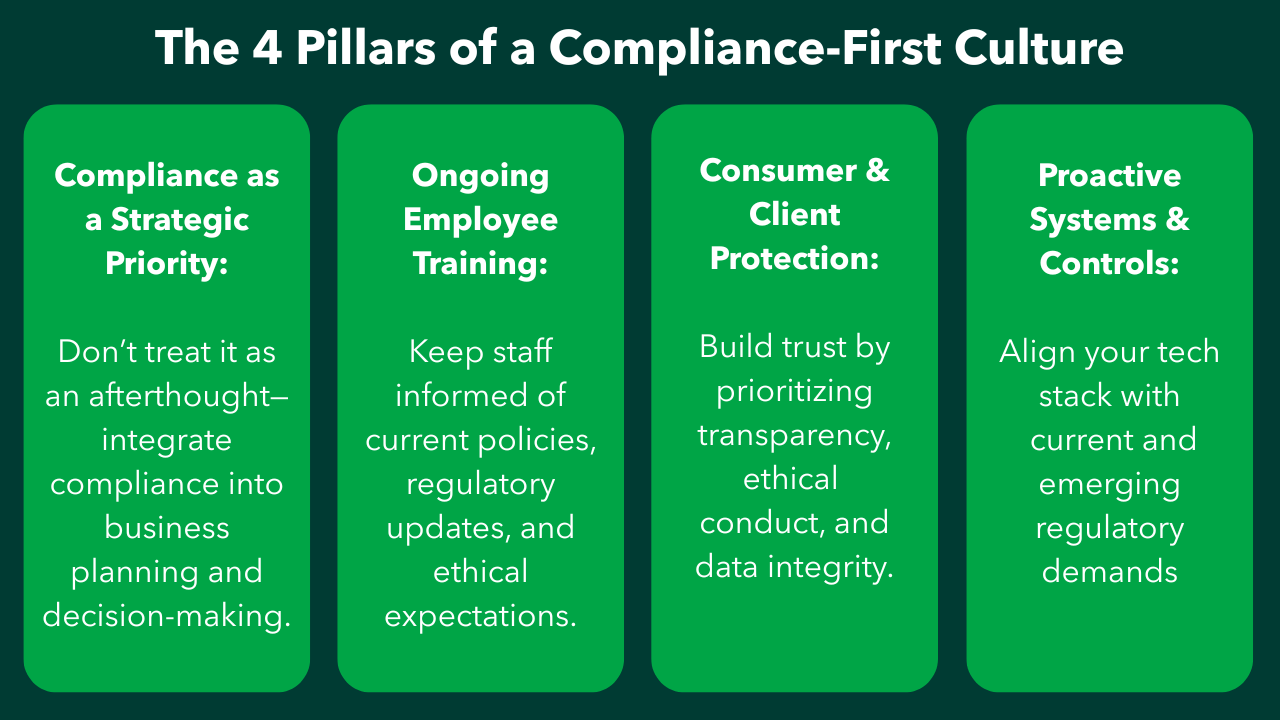

Building a Culture of Compliance

For firms across the finance industry, success no longer depends solely on growth or innovation, it also depends on maintaining compliance.

A compliance-first mindset means:

- Treating compliance regulations as strategic guardrails

- Investing in ongoing employee training

- Prioritizing consumer protection in all product and service decisions

- Aligning your systems with both current and emerging regulatory demands

Compliance as a Competitive Advantage

In the modern regulatory landscape, compliance isn’t just about rules, it’s about resilience. Firms that embed compliance into their DNA gain a strategic edge: stronger client trust, smoother audits, faster time-to-market, and reduced compliance risks. Platforms like Skematic help financial institutions operationalize compliance through centralized workflows, real-time monitoring, and automation making it easier to stay ahead of evolving regulations.

Regulatory compliance for finance is not going away. If anything, it’s becoming more demanding. The firms that lead will be those that plan for it, invest in it, and grow with it.

Talk to our team about how your institution can meet today’s financial compliance challenges with confidence.

Looking to improve your regulatory readiness?Request a Demo